No matter where you are in your career, it is never too early to start thinking about retirement and the pension options available to you. Being prepared for the future could be the difference between living comfortably after retirement and having to tighten the purse strings when you should be enjoying post-work life.

Being knowledgeable about your pension as well as the UK standard will help you to prepare for your future, ensuring that you know how much you will need to save and what your contributions should look like.

In order to help you to be fully prepared for your retirement, I have put together the British Pension Report, covering everything from the standard pension contributions for Brits in the workplace as well as some of the most common questions asked about pensions.

Get a FREE Pension Review

Get a free no obligation pension review today from a qualified financial adviser.

Our partner Unbiased will connect you with one of over 27,000 FCA-regulated advisers.

The British Pension Report Executive Summary

I discovered that people seem to be most concerned about their pensions around mid-life, with those aged between 30 and 59 most likely to make pension contributions of 7% or over. These age groups also had the highest rate of enrolment in workplace pension schemes, ensuring that they are taking care of their futures.

However, I also discovered that the UK has one of the lowest pension payouts in comparison to pre-retirement earnings, making it even more essential to start planning for retirement as early as possible.

Read on further for more insights into the state of the British Pension and how it effects you as a UK citizen.

The scale of pension enrolments

Currently, if you are aged 22 or over, but under the state pension age, are earning more than £10,000 per year and are working in the UK, your employer must auto-enrol you into their workplace pension. You can, however, opt out, but you will receive no contributions from your own earnings or your employer.

So who are the employees most likely to be enrolled into a workplace pension and where are they based?

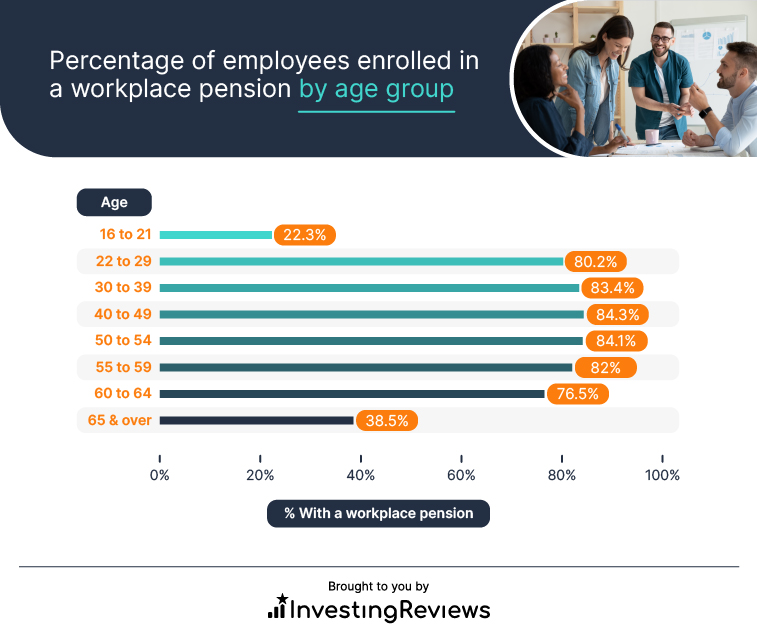

While the 16 to 21 age group has the lowest enrolment rate, this is likely due to the fact that a large number of those in work in this age range will be in part-time employment and low paid work.

The percentage of employees enrolled in workplace pensions seems to peak at the 40 to 49 age group, with it slowly declining as workers get closer to retirement age. Again, this may be partially due to more workers in the older age groups reducing hours or taking on lower-skilled roles, resulting in them no longer being eligible for enrolment in workplace pensions.

Percentage of employees enrolled in a workplace pension by age group

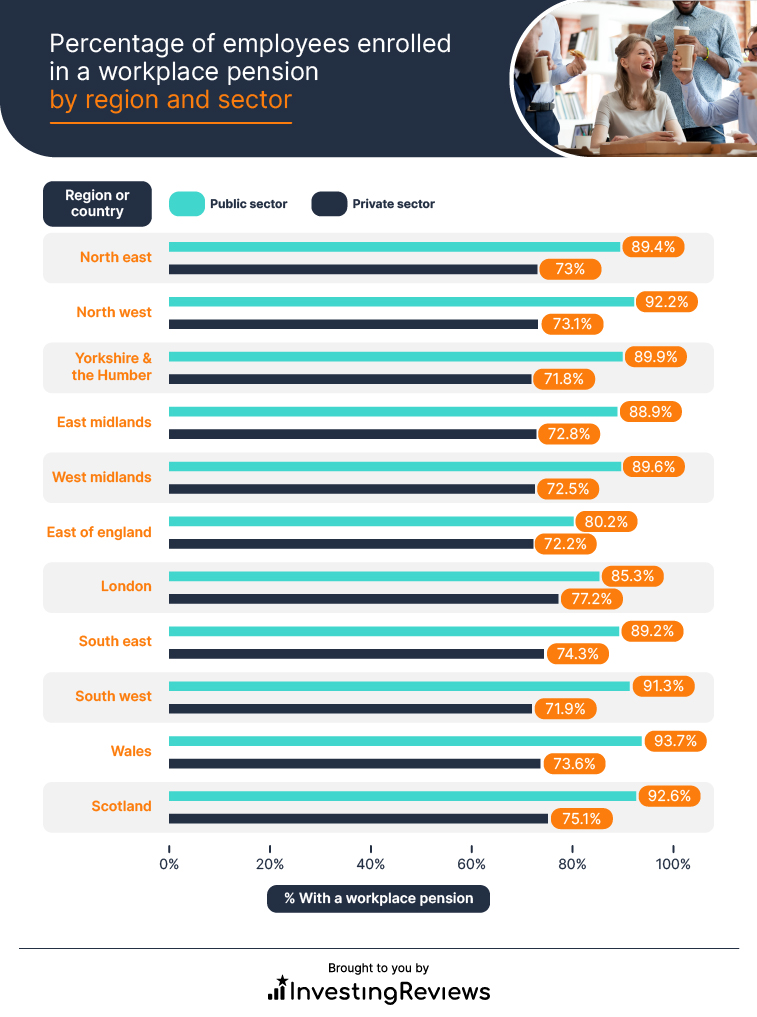

Interestingly, location seems to have an impact on whether employees are enrolled in workplace pensions or not. When we break it down by region, we can see that those living in Wales and working in the public sector are most likely to have a workplace pension, while for those working in the private sector, it is Londoners who are more likely to have a workplace pension.

At the other end of the scale, the public sector workers least likely to be enrolled in a workplace pension live in the East of England, whereas those working in the private sector live in Yorkshire and The Humber.

Percentage of employees enrolled in a workplace pension by region and sector

The employees contributing the most to their pensions

Using government data, I was able to see the types of employees who were contributing the most to their own pension funds based on a number of factors.

Employee contributions by age group

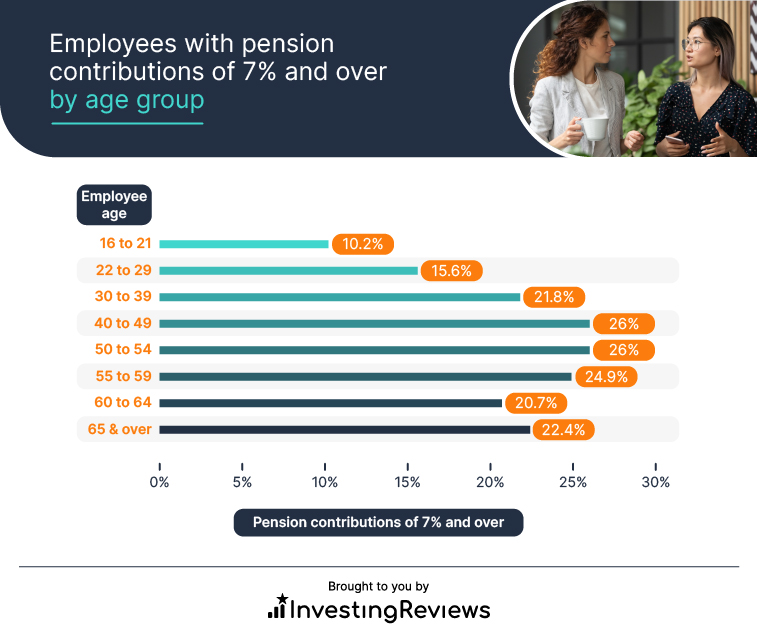

When you look at the employees making the largest contributions to their pensions, I can see that some are willing to set aside 7% or more of their earnings for the future, but which age groups were making these high contributions on the largest scale?

Employees with pension contributions of 7% and over by age group

Unsurprisingly, the youngest age group has the lowest likelihood of high pension contributions, with just 10.2% contributing 7% or more. The age groups with the largest percentage of high contributions were 40-49 and 50-54. This is likely due to a greater sense of job security around this age as well as the obvious factor of being closer to retirement age.

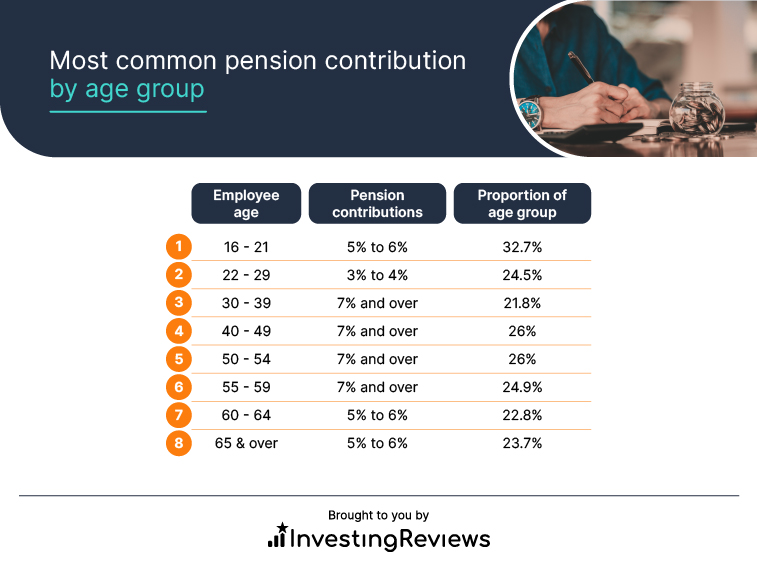

Looking at the most common pension contributions for each age group, we can see the trend in contribution size compared to age group. Between the ages of 30 and 59, employees tend to be making the highest contributions to their pensions, while the majority for all age groups doesn’t drop below 3% contributions, suggesting that UK workers are conscious of their retirement plans.

Most common pension contribution by age group

Employee contributions by occupation

Age is not the only factor in pension contributions, so what about occupation? With each occupation, we can see the impact of salary on pension contributions, though this doesn’t mean that the higher the salary, the higher the contributions. While professional occupations see the highest proportion of workers contributing 7% and over to their pensions, we still see relatively high contributions in lower-paid jobs, such as elementary occupations where contributions of 5% to 6% are most common.

Most common pension contribution by occupation

The employers contributing the most to employee pensions

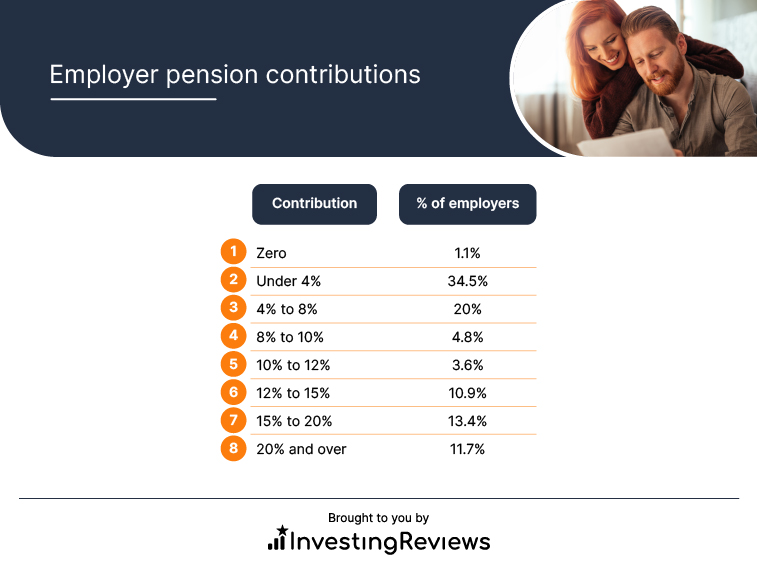

While it’s essential that employees contribute a good percentage of their salaries to their pensions, it is also important for employers to offer a decent contribution. As of April 2021, employers must contribute a minimum of 3% of employee earnings to the pensions of qualifying employees, though some employers offer larger contributions as part of their benefits packages.

Looking at all employers, we can see that the largest proportion contribute the minimum amount, however, there are still plenty of workplaces where employees may be offered far larger employer contributions. In fact, 11.7% of employers pay a huge 20% and over as pension contributions.

Employer pension contributions

The nation’s biggest pension questions

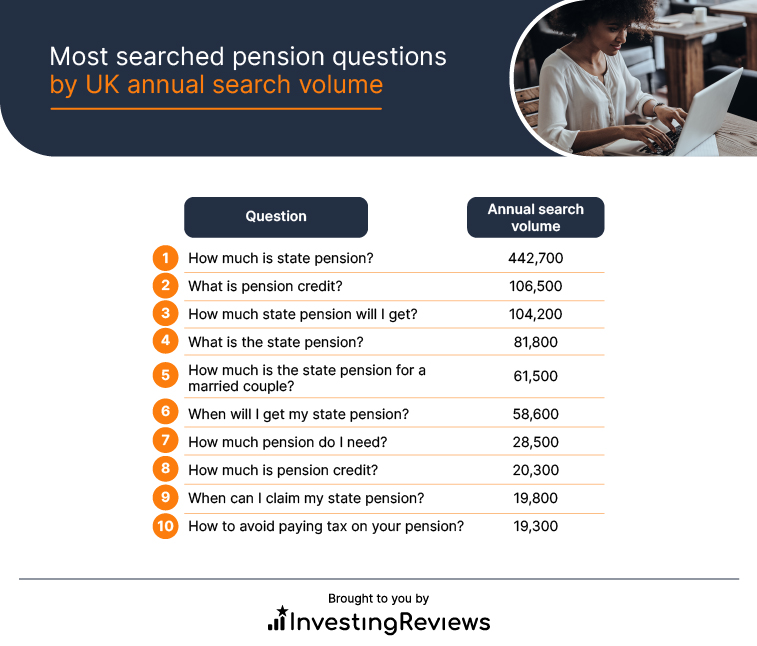

Pensions can seem a little confusing, especially if you’re just starting to get the grips with the basics. This is why many people turn to search engines to ask all the big questions, but what are the most common queries regarding pensions?

Looking at the last twelve months of UK Google searches we were able to see which questions were being asked the most.

The most common pension-related question asked is ‘how much is state pension’, with 442,700 UK searches over the past twelve months. With this question having over 300,000 more searches than the next most common query, it’s clear that this is something that is a big concern for many people.

In answer to this question, the current state pension is £179.60 per week. Of course, with a workplace pension and any other private savings, this amount can be subsidised to boost your income during retirement.

Most searched pension questions by UK annual search volume

Pensions around the world

The final question we want to consider is how UK pensions measure up against pensions around the world. How much do UK retirees receive in comparison to global pensioners?

Looking at OECD data, we can see the percentage of pre-retirement earnings that retirees can expect to receive, measuring how effectively a pension system provides a retirement income to replace earnings.

Taking an average of the results for men and women, we get an average percentage of pre-retirement income that retirees can receive as pensions.

India tops the table with 93.3% of the average income being offered to retirees, ensuring the continuation of their standard of living before retirement. The UK, however, does not feature in the top ten countries, ranking at position 49 out of 51 countries, with only 28.5% of pre-retirement income being offered to retirees. With such a low average pension, it highlights the importance of having other savings or investments ready for retirement in order to supplement the state pension.

The countries providing the highest percentage of pre-retirement earnings in retirement

The countries providing the lowest percentage of pre-retirement earnings in retirement

When we look at the other end of the spectrum, we see that some countries are lagging behind in terms of their pension contributions for retirees. Offering just 23.6% of pre-retirement earnings, Mexico sits at the bottom of the table, while Great Britain takes third place with just 28.5% of pre-retirement earnings offered to retirees.

Methodology:

Data regarding the UK state pension is taken from ONS datasets detailing workplace pensions. This data is from 2020, being the most up-to-date data available.

Google search volumes for pension questions is taken from Google Keyword Planner and looks at annual searches in the UK for each search term.

Global pensions data is taken from OECD’s Net Pension Replacement Rates dataset and takes an average of both men and women’s earnings percentages.

- Learn how to invest in the FTSE100

- Have you considered transferring your pension?

- Find the best trading platforms